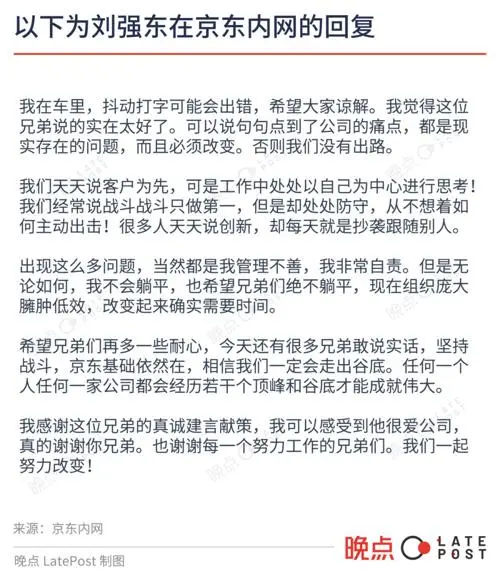

Following Jack Ma’s statement that “Alibaba will change,” Liu Qiangdong has also voiced his opinions. According to reports from “LatePost” and Red Star Capital, on the night of December 9th at 22:00, Liu Qiangdong, the founder and chairman of JD.com, responded to employee comments on the company’s intranet, stating, “Regardless of the situation, I will not lie down flat, and I hope my brothers will never lie down flat either.”

It is understood that recently, an operations staff member at JD.com posted a lengthy article on the intranet, listing some of the issues he sees at JD.com, including: 1. Complex promotional mechanisms; 2. The need for advance planning of the pace and intensity of major promotions; 3. The platform ecosystem needs to provide more support to pop-up store merchants; 4. The mentality of low prices needs to be implemented by everyone consistently.

In response to this employee, Liu Qiangdong stated that JD.com must change; otherwise, there is no way out. “I believe we will definitely emerge from this low point. Any person or company will experience several peaks and troughs to achieve greatness.”

“Many problems have arisen, which are, of course, due to my poor management. I feel very responsible. But in any case, I will not lie down flat, and I hope my brothers will not lie down flat either,” Liu Qiangdong said. “The current organization is large, cumbersome, and inefficient; it indeed takes time to change,” he added.

Liu Qiangdong also criticized on the intranet, saying that many people talk about innovation every day but end up copying and following others.

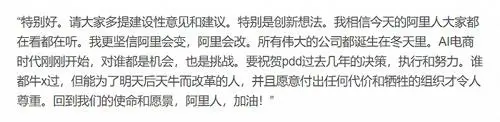

On November 29th, just as Pinduoduo’s market value was about to surpass Alibaba’s, Jack Ma responded to a post on Alibaba’s intranet mentioning Pinduoduo’s market value. He stated, “The era of AI e-commerce has just begun, it is an opportunity and a challenge for everyone. I firmly believe that Alibaba will change, Alibaba will improve.”

On Alibaba’s intranet, an employee posted, “At this moment, it’s hard to sleep, and I dare not think. Pinduoduo’s market value has reached $185.5 billion, compared to our $194.3 billion, a difference of only $8 billion, which is truly shocking. That seemingly insignificant competitor is becoming a big brother. I didn’t want to post this contentless and nutritious post, but my thoughts linger, so I’ll leave this post as a memo and as my own encouragement. I hope to work hard with my group brothers to contribute and surpass.”

Later, another employee commented, “Simple buying, simple returns, fewer tricks, more benefits. I’ve never felt that using Taobao or JD is more high-end than using Pinduoduo. The original intention of making all business transactions easy should be to serve and achieve greater benefits for the people, right?”

Replying as “Partner Jack Ma,” he said, “Very good. Please provide more constructive opinions and suggestions. Especially innovative ideas. I believe all Alibaba employees are watching and listening today. I am more convinced that Alibaba will change, Alibaba will improve. All great companies are born in the winter. The era of AI e-commerce has just begun, it is an opportunity and a challenge. Congratulations to PDD for its decisions, execution, and efforts over the past few years. Anyone can be awesome, but only the organization that reforms for tomorrow and the day after tomorrow, willing to pay any cost and sacrifice, is truly respectable. Back to our mission and vision, Alibaba employees, let’s go!”

After Jack Ma expressed “Alibaba will change” on the intranet, on December 5th, professional investor Duan Yongping posted a transaction image on a social platform, stating that due to his optimism about Alibaba’s future stock performance, he decided to sell some Alibaba put options.

Duan Yongping also quoted a Snowball content he posted in April of this year, “Thinking about Alibaba, sell some puts first,” and according to the two transaction images he shared, he sold two batches of 999 put options each. This time, he plans to sell more Alibaba put options to support it.

The images show that the expiration date of this transaction is January 17, 2025. Some industry analysts believe that this means Duan Yongping is optimistic about Alibaba’s stock price in the next 13 months. Even if the options are at a loss at the expiration, being forced to buy Alibaba stocks would still be worthwhile.

In his comments, Duan Yongping pointed out that he does not understand e-commerce (including Pinduoduo) but likes many things about Jack Ma. “In the past, I thought Jack Ma was great, and today I still think so, regardless of stock price.”

It is worth noting that, in response to a netizen’s message expressing the intention to go all-in with leverage to buy Pinduoduo, Duan Yongping specifically advised against it, stating, “I have never recommended Pinduoduo. If you gamble and it’s your destiny, leverage will sooner or later bring you big trouble.”

Since the beginning of this year, several Wall Street investment banks such as Credit Suisse and Goldman Sachs have continuously issued research reports, reiterating their “buy” ratings on Alibaba. They believe that the market has not fully understood Alibaba’s overall situation and emphasize that the strategies of Taobao and Tmall are starting to show results, forming a positive growth cycle between users, merchants, and the platform.