China is undeniably a powerhouse in manufacturing, with “Made in China” having long been synonymous with quality in the United States. Chinese brands are visible in household appliances, computers, electric vehicles, and more.

In the pharmaceutical sector, companies like WuXi AppTec have made significant strides globally, with many top pharmaceutical companies being clients of WuXi AppTec, representing a significant portion of the global pharmaceutical market. This success is attributed to China’s manufacturing and engineering dividends.

However, it’s puzzling why generic drugs, also reliant on manufacturing and engineering, struggle to gain a foothold in the U.S. market. Setting aside complex international factors, let’s delve into the future development path of China’s generic drug industry from a purely industry perspective.

1. India: “World’s Pharmacy”

Generic drugs’ widespread use is hailed as “one of the greatest advances in public health in the 21st century.” They offer nearly identical efficacy to branded drugs but at a fraction of the cost, making them perfect substitutes.

Despite the value in this arena, Chinese enterprises are conspicuously absent among the leading players. By revenue in 2023, Teva Pharmaceutical Industries topped the list with $15.846 billion, making it the largest multinational generic drug company globally. Half of the top ten multinational generic drug companies are from India. Chinese generic drug companies have lower overseas revenues, limiting their international influence.

Looking at the Indian generic drug companies on the list, they share a common trait: extraordinarily high profit margins. Sun Pharmaceutical Industries boasts a margin as high as 76.4%, while even the lowest, Alembic Pharmaceuticals, stands at 53.3%, significantly higher than U.S. and European companies.

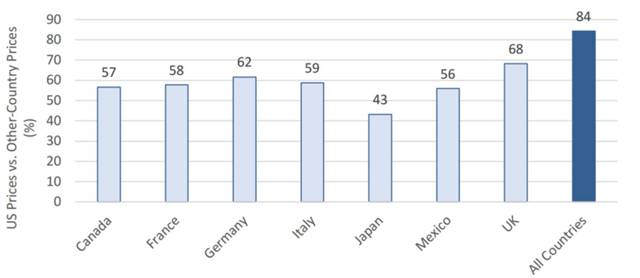

Despite their low prices, drug prices in the U.S. remain significantly higher than the global average. Generic drug prices in Canada, France, Germany, and Italy are about 60% of those in the U.S., while in Japan, they are only 40%. This implies that to become global generic drug giants, entering the U.S. market is essential.

India’s status as the “world’s pharmacy” is mainly due to two factors: significant cost advantages and the ability of Indian companies to enter the U.S. market promptly. These dual factors are also critical considerations for Chinese pharmaceutical companies.

2. “Rogue” Strong Generic Policies

Why are Indian generic drugs so successful? How do they achieve such low costs? This is due to both demographic dividends and national policies.

Firstly, it’s an undeniable fact that labor is cheap in India, with labor costs possibly half of those in China. From a pure cost perspective, India indeed possesses formidable global competitiveness. However, drug development differs from general manufacturing, with labor accounting for only about 30% of costs, while raw materials comprise around 50%. Although China lacks labor cost advantages, Indian companies often source their raw materials from China, resulting in lower costs for China.

In other words, from a purely manufacturing cost perspective, China’s generic drugs can compete with India. However, besides manufacturing costs, time costs must also be considered.

India’s most insoluble point lies in its enforcement of strong generic policies. Strong generic policies involve circumventing patent law restrictions through Chinese legislation, allowing the compulsory replication of patented drugs without the patent holder’s permission. This is a “rogue” tactic; based on these policies, Indian pharmaceutical companies can start replicating branded drugs and selling them domestically as soon as the branded drugs are launched.

Of course, during the patent period, Indian generic drugs cannot enter the U.S. market. However, once the patent expires, Indian pharmaceutical companies immediately submit generic drug applications to the FDA for prompt entry into the U.S. market. To be the first to enter the U.S. market, Indian pharmaceutical companies have even sent people to queue outside the FDA to register, forming a complete industrial chain division of labor. Additionally, Indian generic drug regulations are also trying to align with those of Europe and the United States, indirectly helping them qualify for U.S. market entry.

Strong generic policies enable Indian pharmaceutical companies to establish drug supply chains earlier, ensuring that drugs are fully produced and of stable quality when they enter the U.S. market. This directly results in Indian generic drugs taking the lead at the starting line.

However, this “rogue” model is not without drawbacks. For multinational corporations, this approach prompts them to voluntarily abandon the Indian market, and even new drugs will try to avoid circulating to Indian pharmaceutical companies.

Furthermore, while strong generic policies have fueled the rise of Indian generic drugs, they have also stifled the development of innovative drugs in India. Even if innovative drugs are introduced, they often face the embarrassment of rapid replication domestically, discouraging innovation. This is also why there is such a disconnect between Indian generic drugs and innovative drugs.

Indian generic drugs are low in cost mainly because they have conducted generic drug development earlier and avoid patent litigation disputes. Additionally, the entire supply chain has long been smooth.

3. The Final Barrier: Scalability

In the generic drug arena, India is an extremely formidable opponent, with leading advantages in cost, system, patents, and more. However, these are not the greatest obstacles preventing Chinese generic drugs from entering the U.S. market. The real obstacle is the lack of scalability, which leads to the risk of marginalization.

Although the U.S. pharmaceutical market adopts a market-oriented pricing model, this does not mean that pharmaceutical companies can demand exorbitant prices. While the U.S. government has not officially implemented centralized procurement policies, a private system of price reduction measures for generic drugs has been in place for some time.

Even if a generic drug receives FDA approval, it may not necessarily have a good market. The reason lies in the fact that gaining entry into hospitals still requires rigorous price negotiation processes. Negotiations are not conducted by hospitals but by specialized group purchasing organizations (GPOs). Approximately 96% of treating hospitals, 98% of community hospitals, and 97% of non-governmental non-profit hospitals have joined a GPO, and around 73% of drug purchases in the U.S. are completed through GPOs.

From the essence of the business model, GPOs are intermediary institutions whose bargaining power comes from the procurement rights of member units. The larger the scale of the procurement task, the stronger their core competitiveness. Relevant data indicates that GPOs can reduce hospital procurement costs by about 10-18%, while charging suppliers 1-3% contract management fees.

For Chinese generic drugs to squeeze into the U.S. market, GPOs are the final barrier. How can they become close partners with GPOs? This is not easy. Even if they manage to get onto the GPO supplier list, whether they can enter hospitals still depends on fierce price competition. This is the most challenging obstacle for Chinese generic drugs, which are already latecomers.

The U.S. generic drug market is a typical oligopoly, with a few major players holding significant sway. This is easily understandable because GPOs are under KPI pressure, and they undoubtedly want to maximize profits. How can they effectively reduce negotiation costs? A diverse and stable supply of high-quality products is undoubtedly the best choice, making GPOs more inclined to cooperate with large pharmaceutical companies.

In contrast, Chinese pharmaceutical companies lack inherent speed advantages. Although some products may receive FDA approval, they are not well received by GPOs. On the one hand, the value of a single generic drug product

is not high, making it difficult for GPOs to abandon old customers for new ones. On the other hand, as a latecomer to the market, Chinese generic drugs also find it difficult to establish price advantages. After all, overseas large pharmaceutical companies have many products and can afford to sacrifice the profits of a single product to consolidate relationships as long as overall profits are maintained.

In summary, the cooperation between overseas generic drug companies and GPOs is not on the level of individual drugs but on the level of two major groups. It’s difficult for outsiders to grab a slice of the cake.

From this perspective, for Chinese generic drugs to enter the U.S. market, they not only need strong research and development capabilities and product quality but also need to have a rich product matrix to supply GPO procurement. In the U.S. generic drug market, it’s all about scale and efficiency; both are indispensable.

So how can Chinese generic drugs enter the U.S. market? We believe there are mainly two paths.

Firstly, securing key core drugs, such as those whose patents have expired in recent years, is a good opportunity. This requires speed because only heavyweight products can gain bargaining power in negotiations with GPOs. Secondly, build as diverse a product matrix as possible. Only when the product content library is large enough will GPOs be more inclined to engage in negotiation cooperation. For example, Huahai Pharmaceutical has obtained 96 ANDAs, the highest number approved for any Chinese pharmaceutical company, but it still lags far behind giants with hundreds of ANDAs.

In conclusion, for the Chinese generic drug industry to make significant progress, it must cultivate stronger research and development capabilities and a larger-scale product matrix. As of now, there are still about 4,000 generic drug companies in China, with most lacking strong competitiveness. Therefore, large-scale mergers and acquisitions are a good way to enhance China’s generic drug competitiveness. The future of Chinese generic drugs relies on a few leading enterprises.